Oceanus Reports a Wide Zone of 127 Meters of 2.16 g/t Gold Equivalent Consisting of 1.80 g/t Gold and 27.5 g/t Silver at its El Tigre Property in Sonora, Mexico

Mar 07, 2016HALIFAX, NOVA SCOTIA - March 7, 2016 - Oceanus Resources Corporation (TSXV:OCN) ("Oceanus" or the "Company") is pleased to report results from its infill gap sampling program on the legacy diamond drill core at its El Tigre Property. These assay results indicate a broader halo of gold and silver mineralization than previously recognized. This wide zone of gold and silver mineralization, which starts at surface, may have future potential for open pit bulk mining. After Oceanus included the new assay results for the legacy diamond drill holes, the mineralized intercept for select holes are as follows:

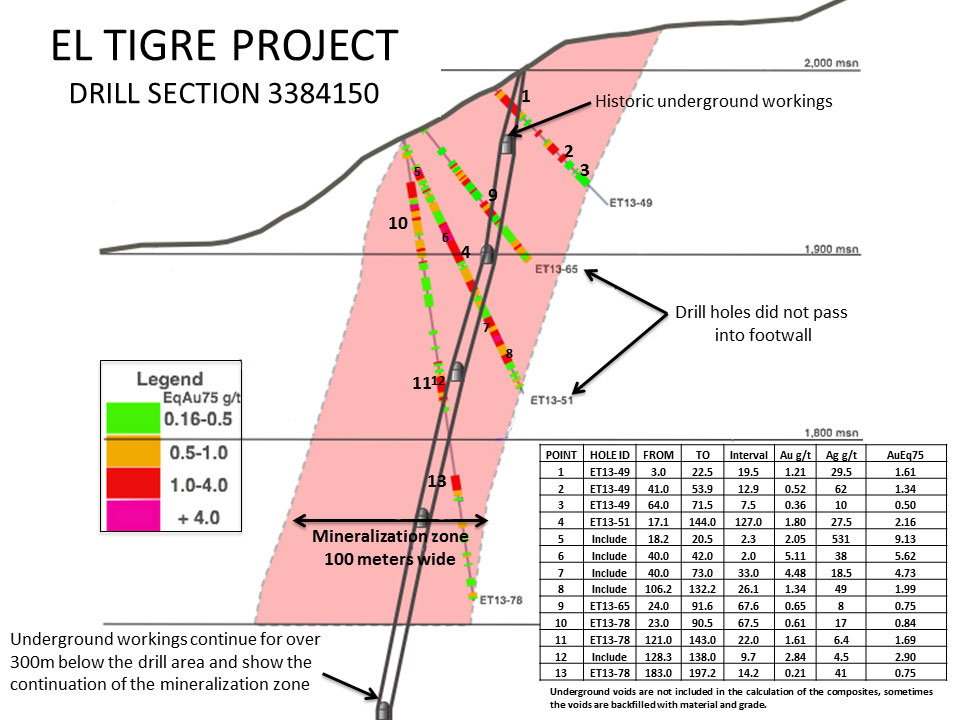

- Hole ET-13-051 - 127.0 meters of 2.16 g/t gold equivalent consisting of 1.80 g/t gold and 27.5 g/t silver; including 33.0 meters of 4.73 g/t gold equivalent consisting of 4.48 g/t gold and 18.5 g/t silver

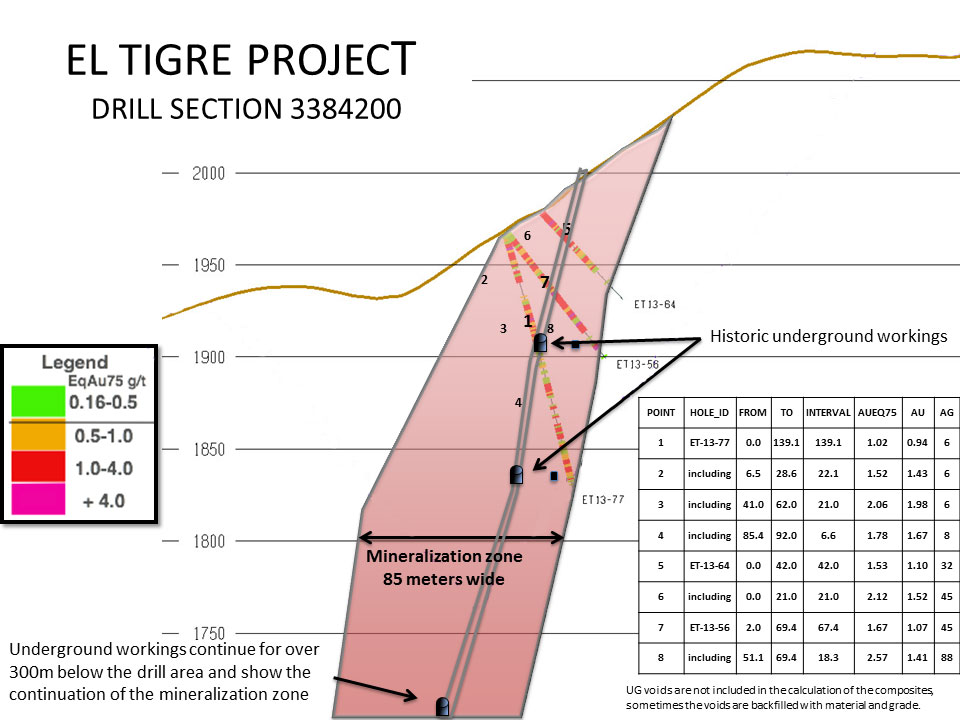

- Hole ET-13-077 - 139.1 meters of 1.02 g/t gold equivalent consisting of 0.94 g/t gold and 6.6 g/t silver

- Hole ET-13-056 - 67.4 meters of 1.67 g/t gold equivalent consisting of 1.07 g/t gold and 44.7 g/t silver

- Hole ET-13-064 - 42.0 meters of 1.53 g/t gold equivalent consisting of 1.10 g/t gold and 32.4 g/t silver

Due to the steep slope of the hillside, many of the legacy drill holes are collared on the mineralization, some have been lost due to the underground workings and others have not fully pierced into the barren footwall. The true width of the drill hole intersections cannot be determined from the information available and further drilling will be required. A table of the drill results and drill sections are presented below.

Glenn Jessome. President and CEO of Oceanus, stated "During acquisition due diligence our team, which has extensive experience in large epithermal deposits in Mexico recognized that the previously unsampled drill core required sampling. We see the greater potential of the El Tigre property as a bulk tonnage target."

Oceanus' initial work program at the El Tigre property entailed the collection of 1,430 samples to fill in the "gaps" in the legacy drill hole assay database to ensure the entire mineralized zones were sampled from the hanging wall to footwall. The new assay results received to date indicate that the mineralized zone at El Tigre approaches true widths of 100 meters. The veins at the El Tigre Property dip steeply to the west. The veins, structures and mineralized zones outcrop on surface and have been traced for a distance of 5.3 kilometers along strike.

For Hole ET-13-051 Oceanus collected 113 continuous samples with the assay results confirming gold and silver grades across the entire 127 meter mineralized section cut by this hole. The hole ended in mineralization. See Figure 1 below.

Figure 1 - Drill Section 3384150

For Hole ET-13-077 Oceanus collected 31 samples primarily to fill in significant gaps between 28.6 meters and 57.5 meters in the El Tigre Silver sampling. El Tigre had collected only 4 samples in this interval. The Oceanus sampling returned a 19 meter interval averaging 1.95 gpt gold and confirmed continuous mineralization over the 139.1 meters. See Figure 2 below.

For Hole ET-13-077 Oceanus collected 31 samples primarily to fill in significant gaps between 28.6 meters and 57.5 meters in the El Tigre Silver sampling. El Tigre had collected only 4 samples in this interval. The Oceanus sampling returned a 19 meter interval averaging 1.95 gpt gold and confirmed continuous mineralization over the 139.1 meters. See Figure 2 below.

Figure 2 - Drill Section 3384200

The table below provides details of the significant intersections for several of the diamond drill holes that were part of the Oceanus infill sampling program.

| Drill Section | Hole ID | Comment | From (meters) |

To (meters) |

Length (meters) |

Au (g/t) |

Ag (g/t) |

Au75 (g/t) |

|---|---|---|---|---|---|---|---|---|

| 4150 | ET-13-051* | 17.1 | 144.0 | 127.0 | 1.80 | 27.5 | 2.16 | |

| including | 40.0 | 73.0 | 33.0 | 4.48 | 18.5 | 4.73 | ||

| including | 106.2 | 132.2 | 26.1 | 1.34 | 48.9 | 1.99 | ||

| 4200 | ET-13-077 | 0.0 | 139.1 | 139.1 | 0.94 | 6.6 | 1.02 | |

| including | 6.5 | 28.6 | 22.1 | 1.44 | 6.0 | 1.53 | ||

| including | 41.0 | 62.0 | 21.0 | 1.98 | 6.5 | 2.06 | ||

| including | 85.4 | 92.0 | 6.6 | 1.67 | 8.1 | 1.78 | ||

| including | 103.7 | 121.0 | 17.3 | 1.02 | 2.6 | 1.06 | ||

| including | 128.0 | 135.0 | 7.0 | 1.47 | 8.3 | 1.58 | ||

| 4200 | ET-13-056 | 2.0 | 69.4 | 67.4 | 1.07 | 44.7 | 1.67 | |

| including | 2.0 | 45.1 | 43.1 | 1.08 | 32.8 | 1.51 | ||

| including | 6.5 | 26.5 | 20.0 | 1.59 | 8.2 | 1.70 | ||

| including | 35.0 | 45.1 | 10.1 | 0.79 | 113.1 | 2.29 | ||

| including | 51.1 | 69.4 | 18.3 | 1.41 | 87.5 | 2.57 | ||

| 78.0 | 81.0 | 3.0 | 4.01 | 2.1 | 4.04 | |||

| 4200 | ET-13-064 | 0.0 | 42.0 | 42.0 | 1.10 | 32.4 | 1.53 | |

| including | 0.0 | 21.0 | 21.0 | 1.52 | 45.4 | 2.12 | ||

| 4250 | ET-13-053 | 0.0 | 80.0 | 80.0 | 0.81 | 12.3 | 0.97 | |

| Including | 0.0 | 14.6 | 14.6 | 1.07 | 10.3 | 1.21 | ||

| Including | 23.6 | 68.0 | 44.4 | 0.93 | 15.4 | 1.13 | ||

| 4150 | ET-13-078* | 23.0 | 90.5 | 67.5 | 0.61 | 16.8 | 0.84 | |

| including | 24.7 | 50.8 | 26.1 | 0.93 | 38.7 | 1.44 | ||

| 121.0 | 143.0 | 22.0 | 1.61 | 6.4 | 1.69 | |||

| including | 128.3 | 138.0 | 9.7 | 2.84 | 4.5 | 2.90 | ||

| Stope Backfill | 183.0 | 190.2 | 7.2 | 0.20 | 41.3 | 0.75 | ||

| 190.2 | 193.9 | 3.7 | 0.14 | 44.8 | 0.73 | |||

| 247.8 | 250.1 | 2.3 | 0.07 | 105.8 | 1.49 | |||

| 4150 | ET-13-065* | 24.0 | 91.6 | 67.6 | 0.65 | 7.7 | 0.75 | |

| including | 26.0 | 65.5 | 39.5 | 0.85 | 6.0 | 0.93 | ||

| including | 52.0 | 65.5 | 13.5 | 1.14 | 8.7 | 1.26 | ||

| and | 72.5 | 91.6 | 19.1 | 0.45 | 13.5 | 0.63 | ||

| 4250 | ET-13-079 | 0.0 | 18.6 | 18.6 | 0.93 | 8.0 | 1.04 | |

| 24.6 | 33.5 | 9.0 | 0.63 | 35.0 | 1.10 | |||

| 42.0 | 58.4 | 16.4 | 0.61 | 12.4 | 0.77 | |||

| OPEN Stope | 58.4 | 59.2 | 0.9 | * | * | * | ||

| 59.2 | 62.9 | 3.7 | 1.00 | 21.9 | 1.29 | |||

| Stope Backfill | 62.9 | 65.8 | 3.0 | 1.03 | 39.8 | 1.56 | ||

| 65.8 | 68.0 | 2.2 | 0.63 | 32.7 | 1.07 | |||

| 72.5 | 86.8 | 14.3 | 0.53 | 5.2 | 0.60 | |||

| 111.0 | 117.0 | 6.0 | 1.15 | 0.7 | 1.16 | |||

Notes:

| (1) | True width has not been calculated for each individual intercept, but true width is generally estimated at 75-90% of drilled width. Metallurgical recoveries and net smelter returns are assumed to be 100% |

| (2) | Gold Equivalent ratio based on gold to silver price ratio of 75:1 Ag:Au. |

| * | Hole did not pierce the footwall unit, ends in mineralization. |

Proposed Exploration Program

Before the end of the third quarter of this year Oceanus intends to re-log the existing drill core, complete further in-fill sampling of unsampled drill core, and complete mapping and sampling of both the surface and underground. The Company intends to design and complete a follow on drilling program that's primary focus will be to explore the newly recognized wide zone of mineralization.

El Tigre Acquisition

On November 13, 2015 Oceanus and El Tigre closed the transaction that combined their respective companies by way of a statutory plan of arrangement pursuant to the Business Corporations Act (British Columbia). Oceanus acquired all of the outstanding common shares of El Tigre Silver Corp. in exchange for common shares of Oceanus. On December 23, 2015 Oceanus completed a non-brokered private placement raising aggregate proceeds of $2,600,000.

El Tigre Property

The El Tigre Property lies at the northern end of the Sierra Madre gold belt which hosts many of the larger multi-million ounce epithermal gold and silver deposits including Ocampo, Pinos Altos, Dolores and Palmarejo. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with the majority of the production coming from the El Tigre vein. Underground mining on the El Tigre vein extended 1,450 meters along strike and mined on 14 levels to a depth of 450 meters. By the time the mine closed in 1938, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012).

The El Tigre Property is approximately 35 kilometers long and comprises 21,842.78 hectares. The El Tigre gold and silver deposit is related to a series of high-grade epithermal veins controlled by a north-south trending structure cutting across the andesitic and rhyolitic tuffs of the Sierra Madre Volcanic Complex within a broad gold and silver mineralized prophylitic alternation zone. The veins dip steeply to the west and are typically 1 meter wide but locally can be up to 5 meters in width. The veins, structures and mineralized zones outcrop on surface and have been traced for a distance of 5.3 kilometers along strike. Historical mining and exploration activities focused on a 1.5 kilometer portion of the southern end of the deposits, principally on the El Tigre, Seitz Kelly and Sooy veins. Four veins in the north (Aguila, Escondida, Fundadora and Protectora) were explored with only limited amounts of production.

Past Drilling Programs

From 1981 to 1984, Anaconda Minerals Company completed an extensive district scale exploration program including geological mapping, test work on the tailings as well as drilling 7,812 meters in 22 holes.

From 2011 to 2013 El Tigre Silver drilled a total of 59 diamond core holes totaling 9,411 meters of drill length to test the potential of the Sooy, El Tigre and Seitz-Kelly veins over a distance of about 1,500 m from the Espuelas Canyon to the Gold Hill area.

El Tigre Mineral Resource

Hard Rock Consulting, LLC of Lakewood, Colorado ("HRC") completed a NI 43-101 report titled "NI 43-101 Technical Report, Preliminary Feasibility Study for the El Tigre Silver Project, Sonora Mexico", filed by El Tigre Silver Corp. on August 15, 2013 with an effective date of June 1, 2013 (the "Technical Report"), which defines an resource at the El Tigre Property. The mineral resource estimate for in-situ material is based on 9,468 meters drilled in 61 diamond core holes conducted in three phases over three years. The mineral resources for the in-situ portion of the El Tigre Project are estimated by HRC to be 9.875 million tonnes grading an average of 0.630 g/t Au and 39.7 g/t Ag classified as indicated mineral resources with an additional 7.042 million tonnes grading an average of 0.589 g/t Au and 36.1 g/t Ag classified as inferred mineral resources. Expressed in terms of Equivalent Gold using a price ratio of 1 g/t Au equals 75 g/t Ag ("EqAu75"), the indicated resource contains 368,000 ounces of EqAu75 and the inferred resource contains 242,000 ounces of EqAu75. Additional information about the mineral resource estimates is included in the Company's Management's Discussion & Analysis for the three and nine months ended December 31, 2015. To the best of the Company's knowledge, information and belief, there is no new material scientific information or technical information that would make the disclosure of the mineral resources or mineral reserves inaccurate or misleading.

Lab Preparation and Assay

The diamond drill core (HQ size) from the 2011 to 2013 El Tigre Silver programs has been stored inside the secure core storage facility. Portions of the drill core from the 1982 and 1983 Anaconda drilling programs are also stored inside the core storage facility. The core is geologically logged, photographed and marked for sampling. When the sample lengths are determined the full core is sawn with a diamond blade core saw with one half of the core being bagged and tagged for assay. The remaining half portion is returned to the core trays for storage and or for metallurgical test work. In sections where the core had been previously sampled, the witness core was sawn in half (quartered) and the remaining quarter is returned to the core trays for storage.

The sealed and tagged sample bags are transported to the ActLabs facility in Zacatecas, Mexico. ActLabs crushes the samples and prepares 200-300 gram pulp samples with ninety percent passing Tyler 150 mesh (106µm). The pulps are assayed for gold using a 50 gram charge by fire assay (Code 1A2-50) and over limits greater than 10 grams per tonne are re-assayed using a gravimetric finish (Code 1A3-50). Silver and multi-element analysis is completed using total digestion (Code 1F2 Total Digestion ICP).

Quality Assurance / Quality Control and Data Verification

Quality assurance and quality control ("QA/QC") procedures include the systematic insertion of blanks, standards and duplicates into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Oceanus' QA/QC protocols.

Qualified Person

David R. Duncan, P. Geo., a director of the Company, is the Qualified Person for Oceanus as defined under National Instrument 43-101. Mr. Duncan has reviewed and approved the scientific and technical information in this press release and has reviewed the Technical Report.

About Oceanus Resources Corporation

Oceanus Resources Corporation is a gold exploration company operating in Mexico. Oceanus is managed by a team of experienced mine finders with extensive experience in exploring and developing large hydrothermal gold projects in Mexico.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@oceanusresources.ca

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, the ability to convert inferred resources to indicated resources, the ability to complete future drilling programs and infill sampling, the ability to extend resource blocks, the similarity of mineralization at El Tigre to the Ocampo mine, exploration results, and future plans and objectives of Oceanus, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Oceanus believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Oceanus's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Oceanus with securities regulators.

© 2025 Silver Tiger Metals Inc.|TSXV:SLVR, OTCQX:SLVTF|Disclaimer

Disclaimer:

User Agreement

The following terms and conditions, along with all other terms and legal notices located on this https://silvertigermetals.com website (collectively, "Terms"), govern your use of this https://silvertigermetals.com website (the "Website"). If you do not understand and agree to be bound by all Terms, do not use this Website. Your use of this Website at any time constitutes a binding agreement by you to abide by these Terms.

Certain material found on this Website is protected by copyright. Certain names, graphics, logos, icons, designs, words, titles or phrases on this Website may constitute trade names, trademarks or service marks of Silver Tiger Metals Inc. ("Silver Tiger") or other entities. Trademarks may be registered in Canada and in other countries, as applicable. The display of trademarks on pages at this Website does not imply that a licence of any kind has been granted.

Although care has been taken in preparing and maintaining the information and materials contained on this Website, they are provided on an "as is" basis, without warranty of any kind, either express or implied, with respect to the accuracy or completeness of the information and Silver Tiger does not assume any responsibility or liability whatsoever for publishing them herein. In using this Website, you agree that Silver Tiger shall not be liable for any damages whatsoever (including indirect, incidental, special, punitive or consequential damages and loss of profits, opportunities or information) arising from (a) your use of or reliance on information contained on this Website; (b) any inaccuracy or omission in such information or failure to keep the information current; (c) use of any third-party web sites linked or referred to in this Website; (d) any delays, inaccuracies or errors in, or in the transmission of, any stock price quotes or historical price data; (e) any Internet software used in connection with this Website or computer viruses or other destructive programs encountered as a result of using this Website; and (f) any other matter connected with the Website, even if Silver Tiger is made aware of the possibility of such claims, damages or losses.

This Website contains links to, or feeds from, sites that Silver Tiger does not maintain. Silver Tiger assumes no responsibility for the contents of third-party sites accessed through links on, or otherwise incorporate in, this Website. Access to or information from such third-party sites is provided for your convenience only. Silver Tiger does not monitor or endorse such third-party sites.

This Website is not to be construed as a form of promotion, an offer to sell securities or as a solicitation to purchase our securities. This Website has been produced as a source of general information only.

Please note that this Website contains "forward-looking information", within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to our plans respecting our mineral projects and our other key mineral properties and the ability to secure and maintain required permits for such projects and properties, exploration expenditures and activities and the possible success of such exploration activities, the estimation of mineral reserves and resources, the realization of mineral estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, mineral pricing, mine life projections, the availability of third-party concentrate, business and acquisition strategies and the timing and possible outcome of pending litigation. Often, but not always, forward-looking information can be identified by the use of words like "plans", "expects", "estimates", "forecasts", "intends", "understands", "anticipates", and similar expressions. Forward-looking information is based on the opinions and estimates of management as of the date such information is provided and is subject to known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), failure of plant, equipment, processes and transportation services to operate as anticipated, dependence on key personnel and employee relations, environmental risks, government regulation, actual results of current exploration activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, land titles, and social and political developments and other risks of the mining industry. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. We do not undertake to update any forward-looking information, except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of us, our financial or operating results or our securities.

Cautionary Note to US Investors

The disclosure on this Website has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Disclosure, including scientific or technical information, has been made in accordance with Canadian National Instrument 43-101 -- Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. As a result, information contained on this Website containing descriptions of the mineral properties or estimates of mineral reserves or resources of Silver Tiger is not comparable to similar information disclosed by U.S. companies in reports filed with the SEC.

For example, the terms "measured mineral resources", "indicated mineral resources", "inferred mineral resources", "proven mineral reserves" and "probable mineral reserves" are used on this Website to comply with the reporting standards in Canada. While those terms are recognized and required by Canadian regulations, the SEC does not recognize them.

Under the rules and regulations of the SEC set forth in Industry Guide 7, a U.S. company may only disclose estimates of proven and probable mineral reserves, and may not disclose estimates of any classification of mineral resources. In addition, the definitions of proven and probable mineral reserves used in NI 43-101 differ from the definitions in the SEC Industry Guide 7. Under United States standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into mineral reserves. Any estimate of mineral reserves or resources has a great amount of uncertainty as to its existence, and great uncertainty as to its economic and legal feasibility with estimates of mineral resources having a greater degree of uncertainty. It cannot be assumed that all or any part of measured mineral resources, indicated mineral resources or inferred mineral resources will ever be upgraded to a mineral reserve or mined. Further, in accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies. Investors are cautioned not to assume that any part of the reported measured mineral resources, indicated mineral resources, or inferred mineral resources on this Website will ever be classified as a reserve. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute reserves as in place tonnage and grade without reference to unit measures.