Oceanus Reports El Tigre Infill Drilling Results and Timing for Resource Estimate Update

Mar 06, 2017HALIFAX, NOVA SCOTIA - March 6, 2017 - Oceanus Resources Corporation (TSXV:OCN and OTCQB:OCNSF) ("Oceanus" or the "Company") reports additional assay results from the ongoing infill diamond drilling program on its 100% owned El Tigre Property in Sonora, Mexico. Highlights from the drilling include the following:

- Hole ET-16-110 - 102 meters of 0.67 g/t gold equivalent from 22.2 meters to 123.9 meters and consisting of 0.5 g/t gold and 13.4 g/t silver; including 13.5 meters of 1.03 g/t gold equivalent consisting of 0.95 g/t gold and 6.3 g/t silver.

- Hole ET-17-118 - 32.9 meters of 1.02 g/t gold equivalent 7.3 meters to 40.1 meters and consisting of 0.27 g/t gold and 56.7 g/t silver; including 8.6 meters of 3.28 g/t gold equivalent consisting of 0.47 g/t gold and 211.4 g/t silver.

- Hole ET-16-116 - 25.7 meters of 1.03 g/t gold equivalent from 83.4 meters to 109.0 meters and consisting of 0.54 g/t gold and 36.9 g/t silver; including 4.3 meters of 3.49 g/t gold equivalent consisting of 1.58 g/t gold and 143.0 g/t silver.

El Tigre Infill Drilling

Since commencing drilling in July through December 15, 2016, Oceanus completed 35 diamond drill holes totalling 6,467 meters of HQ-size core in the first phase of the infill program carried out primarily in the central area of the El Tigre deposit over the past-producing El Tigre Mine. Diamond drilling resumed on January 10, 2017 after a three week break for the holidays. This second phase of the drilling program currently has one drill rig working to test the southern extension of the deposit and the other rig drilling the 500 meter gap to the north between the camp and Mula Mountain. Oceanus has completed another 17 diamond drill holes totalling 2,959 meters of HQ-size core during January and February and anticipates another 15 holes will be drilled during March to complete drilling on the infill sections.

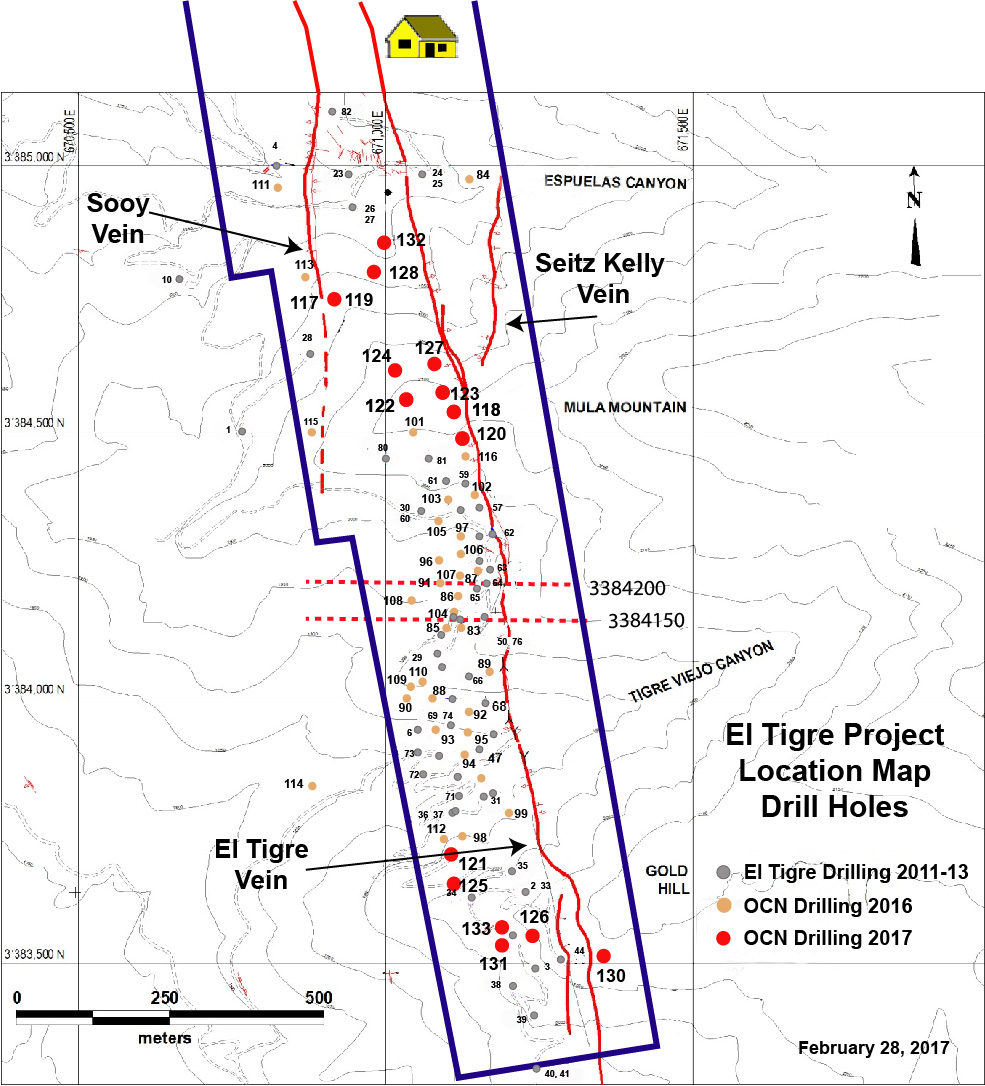

A drill hole location map is attached as Appendix A, a table of significant drill intersections is attached as Appendix B and the drill hole location data is attached as Appendix C.

El Tigre 2017 Resource Estimation

The results from the Oceanus drilling, prior drilling and all other data will be incorporated into a NI 43-101 compliant resource estimation for the El Tigre project to be completed by P&E Mining Consultants Inc. during the second quarter of 2017.

Prospecting Work - Protectora Area

Field mapping and prospecting surveys are in progress along the Protectora Vein system located approximately 1.5 kilometers to the north of the El Tigre camp. Quartz vein and stockwork zones, located near historical workings, are located within an advanced argillic alteration zone. Gold and silver mineralization was discovered along this vein and stockwork zone in diamond drill holes by Anaconda in 1982 (hole ET-82-009 intersected 25 meters of 0.36 g/t gold and 10.2 g/t silver from 127.0 meters to 152.0 meters, including 2.7 meters of 2.14 g/t gold and 30.5 g/t silver from 127.3 meters to 130.0 meters) and El Tigre Silver Corp. in 2013 (hole ET-13-019 intersected 2 meters of 1.41 g/t gold and 421.7 g/t silver from 86.0 meters to 88.0 meters). Oceanus intends to drill test this zone after completing the infill drilling along the El Tigre vein.

Metallurgical Testwork

A metallurgical testwork study is underway. Bottle roll tests on drill core reject and pulp material from Oceanus diamond drill hole ET-16-083 will be completed by Actlabs. Also, new samples will be collected from underground from the walls of the Johnny Cross Cut (section 4400N) where channel sampling by Oceanus in 2016 produced an intersection of 92.6 meters of 1.18 g/t gold equivalent consisting of 0.76 g/t gold and 31.5 g/t silver. Bottle rolls and column tests will be carried out at the Laboratorio Tecnologico de Metalurgia in Hermosillo, Mexico.

Geophysical Survey

In December 2017, Oceanus retained Geofisica TMC to carry out an orientation IP survey at El Tigre. A total of 7.4 line kilometers of pole:dipole survey was completed on 5 lines crossing the vein, stockwork and fracture system. The surveys were completed in January 2017. Lines 7315N and 6745N tested the Fundadora and Protectora veins located several kilometers to the north of the El Tigre mine while the three southern Lines 5150N, 4150N and 3310N tested the Camp, Mula Mountain and Gold Hill zones, respectively. All five lines are showing chargeability highs and resistivity lows associated with the vein and stockwork/fracture zones.

2016 Highlight Intercepts

The following table presents highlight drill intercepts from both the Oceanus infill gap sampling on the legacy El Tigre drill core and the Oceanus 2016 (phase 1) drilling program. The legacy drill holes relating to the infill gap sampling program are referenced ET-10, ET-12 and ET-13, and the drill holes from the 2016 drill program are referenced ET-16.

These drill results exhibit wide oxidized zones of precious-metals mineralization that outcrop at surface.

| Hole ID | Drill Section | From (meters) |

To (meters) |

Length(1) (meters) |

Au (g/t) |

Ag (g/t) |

AuEq(2) (g/t) |

|---|---|---|---|---|---|---|---|

| ET-13-051 | 4150 | 17.1 | 144.0 | 127.0 | 1.80 | 27.5 | 2.16 |

| ET-13-077 | 4200 | 0 | 139.1 | 139.1 | 0.94 | 6.6 | 1.02 |

| ET-13-066 | 4050 | 9.0 | 106.7 | 97.7 | 0.90 | 67.5 | 1.80 |

| ET-13-075 | 4050 | 54.0 | 158.0 | 104.0 | 0.53 | 36.1 | 1.01 |

| ET-10-031 | 3800 | 16.5 | 109.4 | 92.9 | 0.39 | 30.4 | 0.80 |

| ET-12-033 | 3650 | 67.9 | 116.5 | 48.6 | 0.61 | 63.9 | 1.46 |

| ET-16-083 | 4150 | 12.4 | 133.5 | 121.1 | 1.02 | 27.0 | 1.38 |

| ET-16-085 | 4125 | 39.6 | 129.3 | 89.7 | 0.62 | 30.3 | 1.02 |

| ET-16-092 | 3975 | 0 | 95.6 | 95.6 | 1.17 | 13.2 | 1.35 |

| ET-16-096 | 4250 | 43 | 117.2 | 74.2 | 0.80 | 11.6 | 0.96 |

| ET-16-108 | 4175 | 42.7 | 152.7 | 110.0 | 0.60 | 14.5 | 0.79 |

| ET-16-109 | 4025 | 160.9 | 181.3 | 20.4 | 0.40 | 212.0 | 3.23 |

Notes:

- True width has not been calculated for each individual intercept, but true width is generally estimated at 75-90% of drilled width. Metallurgical recoveries and net smelter returns are assumed to be 100%

- Gold Equivalent ratio based on gold to silver price ratio of 75:1 Ag:Au.

El Tigre Property

The El Tigre Property lies at the northern end of the Sierra Madre gold belt which hosts many of the larger multi-million ounce epithermal gold and silver deposits including Ocampo, Pinos Altos, Dolores and Palmarejo. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with the majority of the production coming from the El Tigre vein. Underground mining on the El Tigre vein extended 1,450 meters along strike and mined on 14 levels to a depth of 450 meters. By the time the mine closed in 1938, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012).

The El Tigre Property is approximately 35 kilometers long and comprises 21,842.78 hectares. The El Tigre gold and silver deposit is related to a series of high-grade epithermal veins controlled by a north-south trending structure cutting across the andesitic and rhyolitic tuffs of the Sierra Madre Volcanic Complex within a broad gold and silver mineralized prophylitic alternation zone. The veins dip steeply to the west and are typically 1 meter wide but locally can be up to 5 meters in width. The veins, structures and mineralized zones outcrop on surface and have been traced for a distance of 5.3 kilometers along strike. Historical mining and exploration activities focused on a 1.5 kilometer portion of the southern end of the deposits, principally on the El Tigre, Seitz Kelly and Sooy veins. Four veins in the north (Aguila, Escondida, Fundadora and Protectora) were explored with only limited amounts of production.

Lab Preparation and Assay

The diamond drill core (HQ size) is geologically logged, photographed and marked for sampling. When the sample lengths are determined, the full core is sawn with a diamond blade core saw with one-third of the core being bagged and tagged for assay. The remaining two-thirds portion is returned to the core trays for storage and/or for metallurgical test work.

The sealed and tagged sample bags are transported to the ActLabs facility in Zacatecas, Mexico. ActLabs crushes the samples and prepares 200-300 gram pulp samples with ninety percent passing Tyler 150 mesh (106µm). The pulps are assayed for gold using a 50 gram charge by fire assay (Code 1A2-50) and over limits greater than 10 grams per tonne are re-assayed using a gravimetric finish (Code 1A3-50). Silver and multi-element analysis is completed using total digestion (Code 1F2 Total Digestion ICP).

Quality Assurance / Quality Control and Data Verification

Quality assurance and quality control ("QA/QC") procedures monitor the chain-of-custody of the samples and includes the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Oceanus' QA/QC protocols.

Qualified Person

David R. Duncan, P. Geo., V.P. Exploration of the Company, is the Qualified Person for Oceanus as defined under National Instrument 43-101. Mr. Duncan has reviewed and approved the scientific and technical information in this press release and has reviewed the Technical Report.

About Oceanus Resources Corporation

Oceanus Resources Corporation is a gold exploration company operating in Mexico. Oceanus is managed by a team of mine finders with extensive experience in exploring and developing large hydrothermal gold projects in Mexico. Oceanus is currently drilling and exploring the El Tigre Property in the Sierra Madre Occidental.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@oceanusresources.ca

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, the ability to convert inferred resources to indicated resources, the ability to complete future drilling programs and infill sampling, the ability to extend resource blocks, the similarity of mineralization at El Tigre to the Ocampo mine, exploration results, and future plans and objectives of Oceanus, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Oceanus believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Oceanus's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Oceanus with securities regulators.

APPENDIX A

El Tigre Drill Hole Location Map

APPENDIX B

El Tigre Infill Drilling Results

| Hole ID | Drill Section | Comment | From (meters) |

To (meters) |

Length(1) (meters) |

Au (g/t) |

Ag (g/t) |

AuEq(2) (g/t) |

|---|---|---|---|---|---|---|---|---|

| ET-16-110 | 4025 | 22.2 | 123.9 | 101.7 | 0.49 | 13.4 | 0.67 | |

| including | 32.2 | 37.2 | 5.0 | 1.38 | 62.9 | 2.22 | ||

| including | 55.4 | 68.5 | 13.1 | 0.95 | 6.3 | 1.03 | ||

| OPEN STOPE | 108.5 | 111.2 | 2.7 | El Tigre Vein | ||||

| OPEN STOPE | 123.9 | 126.1 | 2.3 | Seitz Kelly Vein | ||||

| and | 127.5 | 137.0 | 9.5 | 0.22 | 12.0 | 0.38 | ||

| ET-16-111 | 4975 | 29.5 | 34.7 | 5.2 | 0.08 | 37.1 | 0.57 | |

| and | 39.8 | 43.6 | 3.9 | 0.07 | 31.0 | 0.49 | ||

| and | 147.5 | 150.1 | 2.6 | 0.07 | 55.6 | 0.81 | ||

| and | 163.4 | 165.8 | 2.5 | 0.23 | 20.4 | 0.50 | ||

| ET-16-112 | 3750 | 61.3 | 63.0 | 1.7 | 1.23 | 46.8 | 1.85 | |

| and | 74.0 | 79.2 | 5.2 | 0.53 | 2.1 | 0.56 | ||

| and | 87.3 | 103.0 | 15.7 | 0.31 | 4.8 | 0.38 | ||

| and | 107.9 | 110.9 | 3.0 | 0.24 | 2.1 | 0.27 | ||

| and | 132.4 | 139.7 | 7.3 | 0.21 | 9.2 | 0.33 | ||

| and | 150.6 | 157.7 | 7.1 | 0.29 | 5.2 | 0.35 | ||

| OPEN STOPE | 167.9 | 177.0 | 9.1 | El Tigre Vein | ||||

| ET-16-113 | 4800 | 126.5 | 134.7 | 8.2 | 0.14 | 6.5 | 0.23 | |

| and | 156.0 | 188.3 | 32.3 | 0.34 | 8.3 | 0.45 | ||

| including | 163.6 | 170.9 | 7.3 | 0.54 | 31.7 | 0.96 | ||

| OPEN STOPE | 170.9 | 173.0 | 2.1 | El Tigre Vein | ||||

| ET-16-114 | 3850 | 209.5 | 211.0 | 1.5 | 0.17 | 194.1 | 2.76 | |

| and | 243.2 | 256.8 | 13.7 | 0.30 | 2.5 | 0.33 | ||

| and | 265.8 | 278.2 | 12.4 | 0.17 | 8.5 | 0.28 | ||

| OPEN STOPE | 270.0 | 270.8 | 0.8 | El Tigre Vein | ||||

| and | 306.3 | 316.1 | 9.8 | 0.13 | 20.5 | 0.41 | ||

| OPEN STOPE | 317.4 | 318.6 | 1.3 | Seitz Kelly Vein | ||||

| ET-16-115 | 4500 | 214.5 | 225.0 | 10.5 | 0.23 | 3.8 | 0.28 | |

| and | 237.5 | 239.2 | 1.7 | 0.26 | 39.0 | 0.78 | ||

| and | 243.5 | 257.5 | 14.0 | 0.34 | 6.0 | 0.42 | ||

| and | 265.0 | 274.7 | 9.7 | 0.20 | 10.4 | 0.34 | ||

| including | 272.6 | 274.7 | 2.1 | 0.47 | 22.7 | 0.77 | ||

| ET-16-116 | 4425 | OPEN STOPE | 4.6 | 7.7 | 3.3 | El Tigre Vein | ||

| 7.7 | 20.0 | 12.3 | 0.66 | 1.6 | 0.68 | |||

| and | 60.0 | 64.2 | 4.2 | 0.26 | 29.1 | 0.65 | ||

| and | 83.4 | 109.0 | 25.7 | 0.54 | 36.9 | 1.03 | ||

| including | 101.0 | 105.4 | 4.3 | 1.58 | 143.0 | 3.49 | ||

| ET-17-117 | 4725 | 32.9 | 37.4 | 4.5 | 0.78 | 2.5 | 0.81 | |

| and | 57.5 | 63.2 | 5.7 | 0.51 | 0.3 | 0.51 | ||

| and | 141.9 | 147.7 | 5.8 | 0.14 | 8.7 | 0.25 | ||

| and | 173.0 | 197.0 | 24.0 | 0.39 | 13.5 | 0.57 | ||

| including | 184.0 | 188.8 | 4.8 | 0.81 | 35.6 | 1.28 | ||

| OPEN STOPE | 197.0 | 205.0 | 8.0 | El Tigre Vein | ||||

| ET-17-118 | 4475 | 7.3 | 40.1 | 32.9 | 0.27 | 56.7 | 1.02 | |

| including | 31.6 | 40.1 | 8.6 | 0.47 | 211.4 | 3.28 | ||

| including | 34.0 | 34.7 | 0.8 | 3.08 | 1883.4 | 28.19 | ||

| ET-17-119 | 4700 | abandoned | ||||||

| ET-17-120 | 4450 | 1.5 | 39.0 | 37.5 | 0.46 | 20.3 | 0.73 | |

| including | 25.9 | 30.8 | 4.9 | 1.16 | 133.3 | 2.94 | ||

| and | 136.0 | 145.5 | 9.5 | 0.23 | 8.6 | 0.35 | ||

| including | 136.0 | 136.5 | 0.5 | 0.61 | 135.8 | 2.42 | ||

| ET-17-121 | 3725 | pending | ||||||

| ET-17-122 | 4550 | 34.8 | 44.9 | 10.1 | 0.50 | 1.3 | 0.52 | |

| and | 50.5 | 85.6 | 35.2 | 0.22 | 2.2 | 0.25 | ||

| and | 98.0 | 116.5 | 18.5 | 0.30 | 36.4 | 0.79 | ||

| including | 109.5 | 115.2 | 5.7 | 0.58 | 100.6 | 1.92 | ||

Notes:

- True width has not been calculated for each individual intercept, but true width is generally estimated at 75-90% of drilled width. Metallurgical recoveries and net smelter returns are assumed to be 100%

- Gold Equivalent ratio based on gold to silver price ratio of 75:1 Ag:Au.

APPENDIX C

El Tigre 2017 Drill Hole Location Table

| Hole ID | Northing | Easting | Elevation | Azimuth | Dip | Length (meters) |

|---|---|---|---|---|---|---|

| ET-17-117 | 670888 | 3384704 | 1970 | 90 | -45 | 205.1 |

| ET-17-118 | 671120 | 3384500 | 2065 | 90 | -45 | 211.6 |

| ET-17-119 | 670888 | 3384704 | 1970 | 90 | -60 | 50.0 |

| ET-17-120 | 671118 | 3384445 | 2036 | 90 | -45 | 200.7 |

| ET-17-121 | 670987 | 3384900 | 1884 | 90 | -45 | 221.0 |

| ET-17-122 | 671037 | 3384550 | 2099 | 90 | -45 | 147.6 |

| ET-17-123 | 671096 | 3384550 | 2097 | 90 | -45 | 184.3 |

| ET-17-124 | 671021 | 3384600 | 2096 | 90 | -45 | 150.6 |

| ET-17-125 | 671155 | 3383725 | 1960 | 90 | -45 | 215.0 |

| ET-17-126 | 671217 | 3383600 | 2034 | 90 | -45 | 149.0 |

| ET-17-127 | 671112 | 3384600 | 2077 | 90 | -45 | 182.6 |

| ET-17-128 | 670994 | 3384800 | 1938 | 90 | -45 | 156.6 |

| ET-17-129 | 667178 | 3384527 | 1300 | 0 | -90 | 275.5 |

| ET-17-130 | 671269 | 3383550 | 2041 | 90 | -45 | 101.9 |

| ET-17-131 | 671212 | 3383350 | 2013 | 90 | -68 | 259.1 |

| ET-17-132 | 670987 | 3384900 | 1884 | 90 | -45 | 80.0 |

| ET-17-133 | 671236 | 3383500 | 2020 | 90 | -45 | 169.1 |

© 2025 Silver Tiger Metals Inc.|TSXV:SLVR, OTCQX:SLVTF|Disclaimer

Disclaimer:

User Agreement

The following terms and conditions, along with all other terms and legal notices located on this https://silvertigermetals.com website (collectively, "Terms"), govern your use of this https://silvertigermetals.com website (the "Website"). If you do not understand and agree to be bound by all Terms, do not use this Website. Your use of this Website at any time constitutes a binding agreement by you to abide by these Terms.

Certain material found on this Website is protected by copyright. Certain names, graphics, logos, icons, designs, words, titles or phrases on this Website may constitute trade names, trademarks or service marks of Silver Tiger Metals Inc. ("Silver Tiger") or other entities. Trademarks may be registered in Canada and in other countries, as applicable. The display of trademarks on pages at this Website does not imply that a licence of any kind has been granted.

Although care has been taken in preparing and maintaining the information and materials contained on this Website, they are provided on an "as is" basis, without warranty of any kind, either express or implied, with respect to the accuracy or completeness of the information and Silver Tiger does not assume any responsibility or liability whatsoever for publishing them herein. In using this Website, you agree that Silver Tiger shall not be liable for any damages whatsoever (including indirect, incidental, special, punitive or consequential damages and loss of profits, opportunities or information) arising from (a) your use of or reliance on information contained on this Website; (b) any inaccuracy or omission in such information or failure to keep the information current; (c) use of any third-party web sites linked or referred to in this Website; (d) any delays, inaccuracies or errors in, or in the transmission of, any stock price quotes or historical price data; (e) any Internet software used in connection with this Website or computer viruses or other destructive programs encountered as a result of using this Website; and (f) any other matter connected with the Website, even if Silver Tiger is made aware of the possibility of such claims, damages or losses.

This Website contains links to, or feeds from, sites that Silver Tiger does not maintain. Silver Tiger assumes no responsibility for the contents of third-party sites accessed through links on, or otherwise incorporate in, this Website. Access to or information from such third-party sites is provided for your convenience only. Silver Tiger does not monitor or endorse such third-party sites.

This Website is not to be construed as a form of promotion, an offer to sell securities or as a solicitation to purchase our securities. This Website has been produced as a source of general information only.

Please note that this Website contains "forward-looking information", within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to our plans respecting our mineral projects and our other key mineral properties and the ability to secure and maintain required permits for such projects and properties, exploration expenditures and activities and the possible success of such exploration activities, the estimation of mineral reserves and resources, the realization of mineral estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, mineral pricing, mine life projections, the availability of third-party concentrate, business and acquisition strategies and the timing and possible outcome of pending litigation. Often, but not always, forward-looking information can be identified by the use of words like "plans", "expects", "estimates", "forecasts", "intends", "understands", "anticipates", and similar expressions. Forward-looking information is based on the opinions and estimates of management as of the date such information is provided and is subject to known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), failure of plant, equipment, processes and transportation services to operate as anticipated, dependence on key personnel and employee relations, environmental risks, government regulation, actual results of current exploration activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, land titles, and social and political developments and other risks of the mining industry. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. We do not undertake to update any forward-looking information, except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of us, our financial or operating results or our securities.

Cautionary Note to US Investors

The disclosure on this Website has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Disclosure, including scientific or technical information, has been made in accordance with Canadian National Instrument 43-101 -- Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. As a result, information contained on this Website containing descriptions of the mineral properties or estimates of mineral reserves or resources of Silver Tiger is not comparable to similar information disclosed by U.S. companies in reports filed with the SEC.

For example, the terms "measured mineral resources", "indicated mineral resources", "inferred mineral resources", "proven mineral reserves" and "probable mineral reserves" are used on this Website to comply with the reporting standards in Canada. While those terms are recognized and required by Canadian regulations, the SEC does not recognize them.

Under the rules and regulations of the SEC set forth in Industry Guide 7, a U.S. company may only disclose estimates of proven and probable mineral reserves, and may not disclose estimates of any classification of mineral resources. In addition, the definitions of proven and probable mineral reserves used in NI 43-101 differ from the definitions in the SEC Industry Guide 7. Under United States standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into mineral reserves. Any estimate of mineral reserves or resources has a great amount of uncertainty as to its existence, and great uncertainty as to its economic and legal feasibility with estimates of mineral resources having a greater degree of uncertainty. It cannot be assumed that all or any part of measured mineral resources, indicated mineral resources or inferred mineral resources will ever be upgraded to a mineral reserve or mined. Further, in accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies. Investors are cautioned not to assume that any part of the reported measured mineral resources, indicated mineral resources, or inferred mineral resources on this Website will ever be classified as a reserve. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute reserves as in place tonnage and grade without reference to unit measures.